The COVID-19 pandemic is arguably the biggest factor driving the acceleration of customer service digitalisation.

According to data from McKinsey & Company, the coronavirus crisis led to the global average share of digital customer interactions surging from 36% in 2019 to 58% in 2020 — an accelerated rate of growth equivalent to that of three years. This, in turn, led to a 20% leap in the global average share of partially or fully digitised products and services — equivalent to seven years of normal growth.

Unsurprisingly, this surge in digital consumer activity has a ripple effect on how customers expect to be engaged. We look at three examples of how digital technologies are changing the customer service landscape.

1. Using Automation to Handle the Deluge of Customer Queries

Sectors that are constantly bombarded by customer queries — think retail and banking — often have high contact centre costs due to all the calls, emails and messages they receive every day. However, most customer questions typically revolve around the same set of issues. With eCommerce, for example, these can include:

- Where is my order?

- What payment methods do you accept?

- What are your shipping charges?

- How do I report a problem with my order?

- How do I file a warranty claim?

These simple questions take up too much time and inconvenience for your customers and customer support teams.

- For customer service teams, simple interactions are repetitive and time-consuming.

- On the other hand, it’s not fair for customers to sit in a call queue for several minutes just to ask a simple question about a product or order.

This is where automation comes in. Solutions such as retail chatbots can answer your customers’ frequently asked questions and enable self-service, allowing your live agents to focus on more complex conversations.

2. Using Data Analytics to Understand Customer Sentiment

Customer data reveals a wealth of insights about your customers’ preferences, shopping behaviour, pain points and challenges. It also offers valuable demographic data, enabling you to create buyer personas to guide your marketing and sales activities.

It should come as no surprise then that global spending on data analytics is predicted to reach $215.7 billion in 2021, according to a report by IDC. The science of data analytics makes the invisible visible, revealing trends about your customers’ needs before they’ve even voiced what they want from you.

To begin using data analytics, you’ll first need a customer relationship management (CRM) tool, like Salesforce or HubSpot. These platforms come with a built-in analytics dashboard that lets you track customer satisfaction metrics, such as:

- Net Promoter Score

- Average Ticket Count

- First-Contact Resolution Rate

- Average Response Time.

Retail chatbots can help brands leverage automation to capture feedback from customers using quick pulse surveys. This can yield valuable insights into your customers’ mood and engagement levels.

3. Creating an Omnichannel Presence

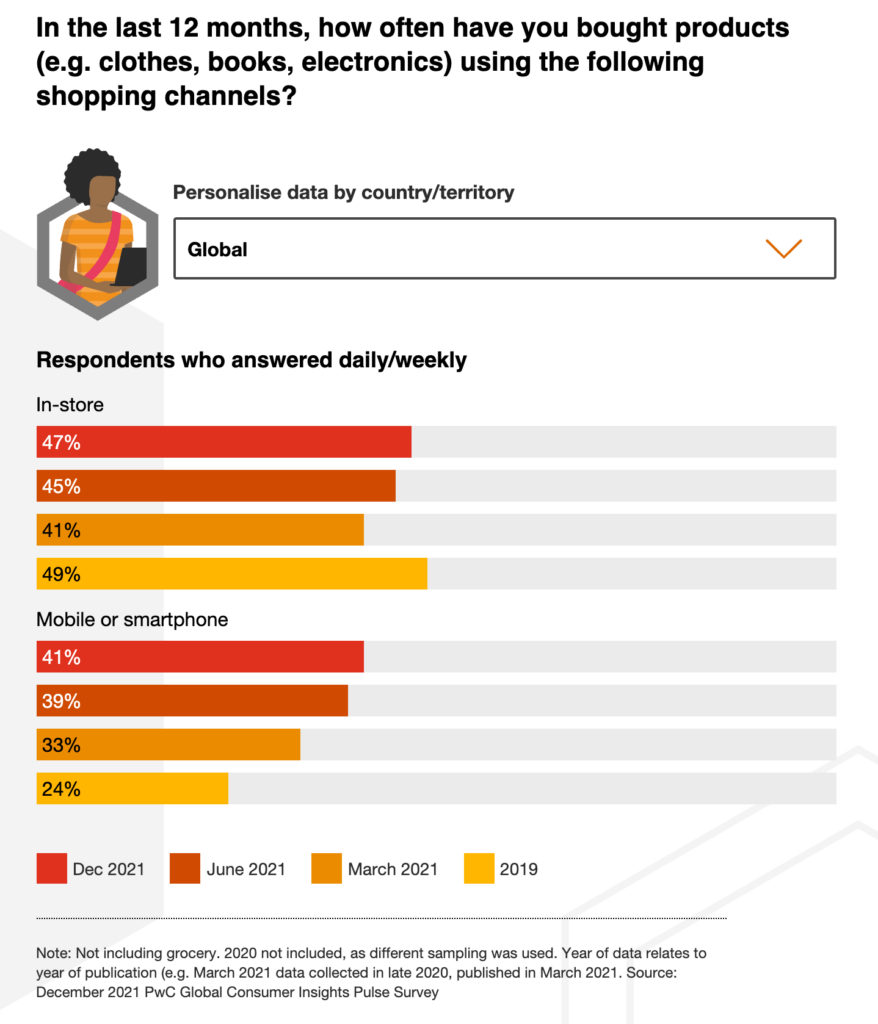

Image Source: PwC

PwC’s December 2021 Global Consumer Insights Pulse Survey shows that mobile is far and away the top channel for online shopping, with 41% of respondents saying that they use their phones to shop daily or weekly. That’s up from 33% just nine months ago and 24% in 2019.

Businesses that don’t scale their customer support abilities on mobile users’ favourite apps are setting themselves up to miss opportunities for customer engagement. Now is the perfect time to set up official customer support channels on Facebook, Twitter, Instagram, WhatsApp and more.

This is where chatbot platforms can help you consolidate your customer service channels, providing an integrated view of your conversations from one dashboard. This makes it easier to see what people are asking your bots and track their overall mood.