Even if you are not a resident of Britain or a foreigner, it is possible for you to buy a business in the UK provided you should abide by certain rules and conditions to buy any business that you have planned to. Moreover, it would be beneficial for an individual to invest in the UK since the laws and rules related to the business are very much transparent, appealing, and investment-friendly for the people to buy companies as per the requirement even for a non-resident.

If you had planned to buy a company in the UK or start a small business in the UK then there are certain eligibility criteria and conditions that you should fulfill. The purchase deals may vary from business to business, but in this article, you can find the overall guide/principles to buy a business in the UK that applied to all types of business.

Criteria & Aspects Considered buying a company in the UK as Foreigner

Besides all these, there are plenty of business opportunities available in the UK for foreigners. The first criteria are that you should work full time or be actively involved in the business trading under your own account or in partnership as a director.

You should not be in any other employment in the UK rather than the work process involved in your business. In addition, you should be ready to invest or render services that actually needed for your business in the UK.

Apart from the above criteria, there are also some of the aspects or factors to consider when buying a company in the UK as a foreigner and they are,

Payment Estimation Structure

When you had planned to buy a company as a foreigner in the UK, the first thing you have to look into is the Price you fix to buy that company. This can be fixed by determining the

- Assets or net Profit of the Company

- Business Performance currently and in the forthcoming years after the purchase

- Based on the years or months the company has deferred

Still many other aspects based on the business nature, whereas the above-mentioned remains the same for all types of business. While taking over an existing company, you must be provided with a written statement of you taking over the business along with the auditing statements of previous years. In addition, certain people from certain nationalities can apply for the “European Community Association Agreement”, which when people qualify this agreement will not require a work permit. Countries included in the process are Bulgaria, Estonia, Hungary, Lithuania, and Romania.

Sales Documents and Agreement

When buying a company in the UK, the Sales and Purchase Agreement must be very clear and transparent. It should include the following documents,

- Warranties provided by the seller

- Employment Contracts- At the time of joining a few employees may enter with an employment contract on years or months all those details handed over by the seller to the buyer for future reference.

- Shareholders Agreement-, which is more important in a business. Details of all shareholders provided.

- All Financial Statements involved

- Transition service Arrangements

- Confidential documents from the seller and the limitations on liability

- Tax Covenant- The tax analysis may be complicated during the purchase of a company in the UK, so one should focus more on the account status of a seller as well as the buyer.

These are some of the important documents provided to the buyer when buying a company and for more details; you can refer to the Laws of the UK Government related to the business structure.

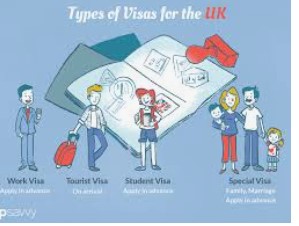

Visa Requirements

An individual must be clear with all the rules, laws about the UK government, know the ways of how/stipulations of a non-resident of UK to start up a business in the UK or buy a company in the UK; along with all these should certainly have a visa or apply for the UK citizenship before they start their business.

There are different visas available in the UK based on the nature of your business and work. For Example, the tier 1 visa is opted for the entrepreneurs/ sole traders and similarly others for skilled workers and so on. So choose the correct visa type for you and plan accordingly. You must also be ready with the funding for your business investment in the UK based on the business structure you choose like the private limited company(ltd), Public limited company, etc.

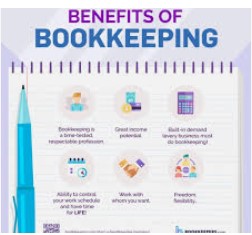

Business Insurance

After the complete analysis and verification of the above process like documents and agreements and had satisfied the visa requirement, last but not least you must be aware of the business insurance more important factor to run a business smoothly in the UK. You should ensure that you have the right level of insurance to abide by the UK Laws and protect your business in the right way. Similar to the visa there are different types of business insurance available from which the individual has to choose the right one based on the nature of his/her business.

It is also important that you have a consultation of finances, taxation, and business planning of your business with the perfect expert or find it from the UK government’s website. The site will provide you the details of current supporting schemes for your business and details of the startup loans.

Conclusion

Hope this article has covered all the aspects involved to be known by the individual when planned to buy a business in the UK as a foreigner. Focus more on the above-mentioned factors, run your business successively in the UK, to reach your Goal. All the Best for your future endeavors.